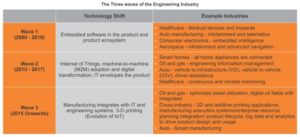

The integration of IT into daily life has already impacted the world to a very great extent. And this implementation is expanding day by day. Every year, the products are introduced with tight IT integration in them. ‘Smart’ is a new concept today and every product is getting smarter every year. Smart objects such as lights that automatically turn on and off are the next big thing. With such expansion of IT, the growth of engineering service outsourcing (ESO) industry is also booming. The ESO providers have taken the lead when it comes to integrating IT and engineering. There are three waves of evolution in this industry, and we are currently in the second wave.

Wave 1 (2000 – 2010)

The first wave of engineering services is the services of yesterday. The enterprises till date consider engineering services as an extension of the engineering organizations. The market of ESO has remained smaller when compared to IT outsourcing (ITO) or business process outsourcing (BPO). The ESO has always survived with a core group of service providers and the engagements have contacts that are tactical and delivered through time-and-materials (T&M) arrangements.

From the data collected in 2014, it was found that a quarter of the overall engineering services market was accounted by India-based providers. The worth of this quarter of the market is approximately US $80 million per year. The Engineering Service Providers (ESPs) and the Global Engineering Centers (GECs) make up the Indian ESO industry and almost half of the top 500 R&D spenders operate through these GECs in India.

Wave 2 (2010- 2017)

Technology has advanced in many fields like sensors, distributed company, wireless communications, and big-data. These technologies are provisioning the rapid transformation of the Internet of Things (IoT). The consumer expectations are increasing at a very fast pace and thus embedded electronics and IT are permeating the service and product engineering services.

In all the industries, the firms are dealing with a wide range of devices and data. These challenges create a unique opportunity for ESO providers. The ESO providers can create intelligent engineering applications that can monitor and customize the entire experience of any product. There are several ideas such as real-time health care, smart homes and remote monitoring them, connected cars and much more. The created intelligent products store their own data and use it to establish a feedback loop. The OEMs can constantly deliver intelligent products as-a-service whose customer experience and product evolution are defined using software applications.

Wave 3 (2015 onwards)

In the third wave, the ESO industry integrates manufacturing as the third field of expertise. The security in the industrial internet is increasing day by day which is creating a new dynamic in robotics, 3D printing, and industrial automation. The third change is beginning and has two phases.

- With the evolution of “Digital Shop Floor”, the previously collected information will integrate with systems like product Lifecycle management (PLM), Enterprise resource Planning (ERP), and Manufacturing Execution Systems (MES). Such integration will increase the productivity, optimize the operational costs, improve the safety, and enhance asset uptime utility.

- The product maintenance and the repair requirements will have a lot of impact with the introduction of design-to-print concepts of additive and 3D manufacturing. For example, a washing machine that has the ability to provide 24/7 monitoring and can trigger the local provider with the need of printing a spare part.

Engineering Services and its changing nature

The need for change in the ESO delivery model has risen to realize the full potential of the growth capacities of technology. The current GECs must broaden their scope and invest further to meet all the upcoming challenges of IT-enabled engineering. Moreover, the GECs must also leverage the exposure, experience, and ESO providers’ investments.

In the future, the managed service contracts for ESO will require shifting from traditional engagement models to demand tight integration of service which includes key performance indicators, metrics of client business, and service level agreements that are stringent. In such way, the business model will move towards sharing risk and reward between the service providers and the client.