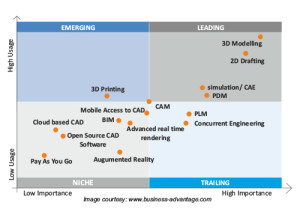

The Business Advantage Group – the IT, software and telecom industry research specialist, announced its Worldwide CAD Trends 2016 Survey, specific to Concurrent Engineering. The survey results are based on responses from CAD users, Designers, Engineers, Professionals including managers and senior executives.

Concurrent engineering, also known as simultaneous engineering, is a method of designing and developing products, in which the different stages run simultaneously, rather than consecutively. It decreases product development time and also the time to market, leading to improved productivity and reduced costs. For Concurrent Engineering the growth predicted in the 2015 report did not materialize – usage has remained flat (19%-18%) through 2015. Users continue to rate its Importance highly – it is the 6th most important CAD trend from the survey. However users continue to predict growth – 33% this year (from 18% to 24% usage) and 72% within 5 years (from 18% to 31%).

Awareness of Concurrent Engineering is 52% in large companies, 45% in medium sized companies and 39% in small companies. Similarly, Usage is highest in North America (21%) compared to EMEA (16%) or APAC (14%). The leading reason given for not using Concurrent Engineering was incompatibility with existing systems which is obviously a prerequisite for multiple users working on a single model real-time.

The top 10 leading software tools by market share are listed below. The highest market share for a single software solution is just 12% and there is no clear market leader, although from a vendor point of view Autodesk leads with 5 of the top 10 software solutions!

• Design Review 12% (17% of Autodesk users also use Design Review)

• Vault 11% (16% of Autodesk users also use Vault)

• Navisworks 11% (mainly in AEC at 21%, 15% of Autodesk users also use Navisworks)

• Windchill 8% (mainly in manufacturing at 12%, 42% of PTC CAD users also use Windchill)

• A360 8% (mainly in AEC at 12%, 11% of Autodesk users also use A360)

• Teamcenter 7% (mainly in manufacturing at 14%, 42% of Siemens CAD users also use Teamcenter)

• ProjectWise 4% (mainly in AEC at 7%, 38% of Bentley users also use ProjectWise)

• Buzzsaw 5% ( 7% of Autodesk and 6% of PTC users also use Buzzsaw)

• Enterprise PDM 4% (mainly in Manufacturing at 6%, 12% of Dassault users also use Enterprise PDM

• ProjectWise 4% (mainly in AEC at 7%, 38% of Bentley users also use ProjectWise)

Image courtesy: www.business-advantage.com

akh students appear for the JEE Mains Entrance Examination, making it one of the largest entrance exams globally. The most common dilemma among engineering aspirants is, about the “Best Engineering Branch” to choose. Basically, what matters in choosing your branch is your personal interest and aptitude for that particular branch. Some of the trending Engineering courses to go for in 2016 can be:

akh students appear for the JEE Mains Entrance Examination, making it one of the largest entrance exams globally. The most common dilemma among engineering aspirants is, about the “Best Engineering Branch” to choose. Basically, what matters in choosing your branch is your personal interest and aptitude for that particular branch. Some of the trending Engineering courses to go for in 2016 can be: